GenPro Quarterly Bulletin

January – March 2023

Commercial Updates

Following the high inflation seen in 2022 and ongoing disruption from Russia’s invasion in Ukraine, the World Bank is forecasting a 1.7% decline in global growth in 2023, which is 1.3% below the previous forecast made six months ago (or down from 3% predicted last June). As a result, most commodity prices have eased.

Energy prices declined by nearly 9% in January over a 12-month period with crude oil prices steadily declining from their mid-2022 peak, but overall remain relatively higher than the pre-pandemic and pre-inflationary levels.

Natural gas prices, and to a lesser extent coal, have fallen towards the pre-invasion prices by more than 40% as a warm winter, especially in the US and Europe, resulted in a lower demand for generating power.

According to FAO Food Price Index, food prices continued to drop in February 2023 for the 11th consecutive month. Overall, compared to the increase recorded in March 2022, food prices dropped by 18.7%. A significant drop is particularly reflected in the price of vegetable oils and dairy, together with a lesser drop in prices of cereals and meat, whilst there has been a sharp rise in the sugar price index.

The re-opening of China and the rising demand for the renewable energy sector, led to a 6% increase in metal prices in January 2023 compared to January 2022, with tin increasing by 16%, iron ore by 9% and copper by 8%.

In relation to freight rates, the Drewry’s World Container Index has decreased by 2% and a 40-feet container has dropped 80% since its peak back in September 2021, indicating a return to more normal prices, although this still remains 31% higher than the pre-pandemic rates.

Regarding the short and medium-term forecast, our suppliers do not foresee any major shortages on provisions, technical consumables and stores. However, this situation might change at any time due to volatility.

Lube Oil Desk

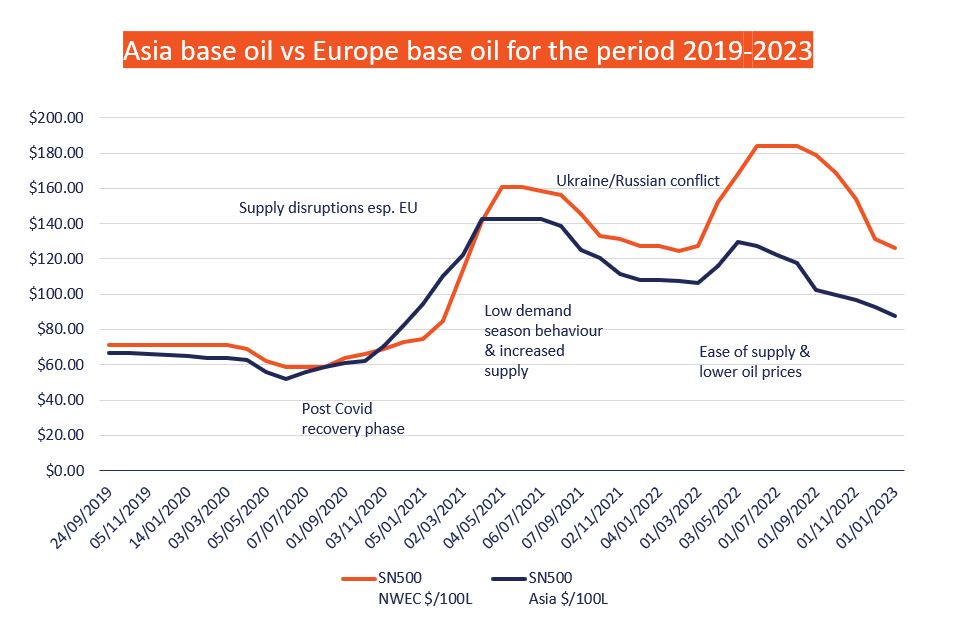

Price decreases in January were greater than expected and Q1 2023 has definitely seen some cost release across all regions.

The combination of base oil shortages and price spikes in early 2022 now seems far away. However, there are still several factors that could lead to uncertain market conditions. The 5th February products embargo on Russia to Europe has now come into play and the market is in a ‘wait and see’ mode regarding the effect.

Gas oil margins have picked up and if such a trend is to continue, this would add pressure on base oil supply.

For now, prices are set to remain stable or rise in general until the end of Q2 2023.

Supply has been steady so far this quarter but there are signs of this becoming more balanced or even tightening towards Q2. It should be noted that in general, industry insight indicates that a net improvement in supply as reductions in refinery runs are not expected.

However, a fall in refining output could occur, depending on the forthcoming recession and its severity, which may reduce base oil supply and have an impact also on base oil pricing.

Oil prices are strongly influenced by the global economic outlook.

Changes in supply and demand and geopolitical tensions cause price fluctuations. Demand for oil plunged in 2020 during the pandemic when lockdowns led the price to fall below minimum levels first time in the history due to a major downturn in economic activity. Since then prices have risen sharply following strong economic recovery post-lockdowns. As the economy grows so does the demand for oil.

The geopolitical tensions between Russia and Ukraine and in the Middle East are effecting again the price fluctuations.

Compliance & Sustainability Updates

On the Compliance and Sustainability front, the overall trend is positive and we remain optimistic that 2023 GenPro will achieve its Compliance and Sustainability goals.

In 2022 the team completed 28 Audits, physically inspecting in total 30 warehouses of 187,537 sqm and more than 10,000 items.

Going forward, GenPro is unique to the marine supply chain as the first company to audit all its Suppliers within two-year cycles. Substantial travel costs will be saved as well as a reduction of our carbon footprint as the team embarks on a combination of physical and virtual audits. For 2023 that translates into 67 physical and 103 virtual audits.

In terms of performance, the overall Supplier Compliance & Sustainability Readiness Score remains at 41%.

Striving for improvement means looking at different ways to improve supply chain efficiencies. One of these ways, is through the use of Balance Score cards where quantifiable measures are listed.

The criteria for suppliers are as shown below:

Regulatory: Enforced by National or Global Legislation – unable to deviate from

Mandatory: Enforced by GenPro – full and strict adherence expected. Minimal exceptions to apply only where National / Local Regulations cancel the Requirement (ex. Australia Ports)

Preferred: Preferred by GenPro – supplier to embrace and support the initiative

Promoted: Promoted by GenPro – supplier to consider and support the initiative

The 2022 Balanced Scorecards for our entire pool of suppliers have been circulated to our suppliers.

Finally, GenPro’s Compliance & Sustainability team are now preparing a series of four webinars to which suppliers and/or members will be invited to accordingly and in due course.

Supply Chain Sustainability in the Age of Plastics

GenPro was recently invited to contribute to the IMPA Supply Chain & Sustainability magazine. Our Compliance & Sustainability Officer, Christodoulos Manoli, wrote on the subject of Supply Chain Sustainability in the Age of Plastics.

GENPRO CONTRACTED SUPPLIERS

NEW TEAM MEMBERS

Natalie joined GenPro as a Marketing Officer in February 2023.

With 23 years of experience in the maritime sector, Natalie has spent over 10 of those years as a communications expert, editing business publications and acting as a media responder. Her previous roles included leading an editorial team to produce magazines, internal business and crew newsletters.